The 4 Best Budgeting Apps To Replace Mint

Budgeting can be a difficult thing to wrap your head around, with credit cards demanding so much of our spending and checking out is as easy as a tap. While you could lean on ChatGPT tips to save money, considering a high-quality budgeting app can take out a lot of the guesswork. Mint was the gold standard for many years — serving as one of the earliest and most trusted ways to get a handle on your spending and your accounts.

But in March of 2024, Mint's parent company Intuit shut down the standalone app to direct users to its other service, Credit Karma. While this shutdown left many users questioning why and how, it also left them wondering where to turn to replace Mint. Whether you're looking for an easy-to-use budget app like Mint, you want something wholly different, or you just want a FinTech app that's more helpful than Robinhood, there's a lot to consider out there.

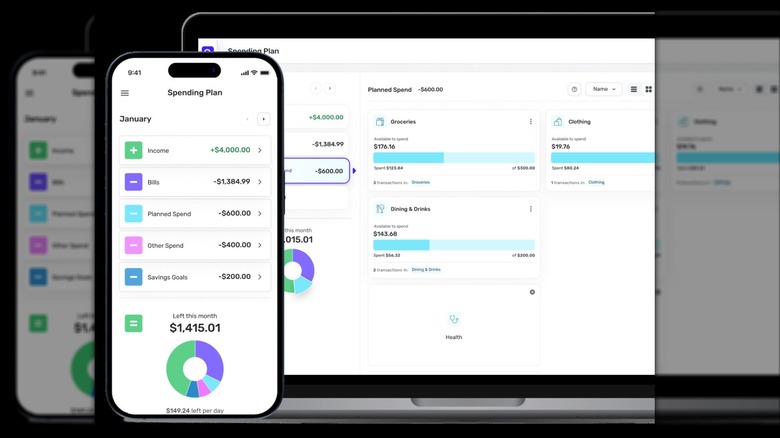

Quicken Simplifi

Quicken on the whole is a popular choice for small business owners and bookkeepers thanks to its powerful business tracking tools and in-depth reporting. Quicken Simplifi, as the name implies, is really meant as a simpler choice aimed at those who want to budget for their personal lives. Unlike some of Quicken's other programs, Simplifi is available through a web browser, so you can check in without the need to install an app. There is, of course, also a mobile app that offers many of the same features.

Quicken's goal with the Simplifi app is to provide a more "automatic" approach to budgeting. Rather than manually assigning spending category goals, the app takes your inputted accounts and spending history, and manages the tracking for you. It delivers what Quicken calls a Spend Plan that's customized to your behavior every month. This makes it great for someone who wants a holistic look at their budget and what to do, but doesn't want to spend a whole lot of time considering and adjusting. Many satisfied users support the simplicity, especially when compared to complicated spreadsheets.

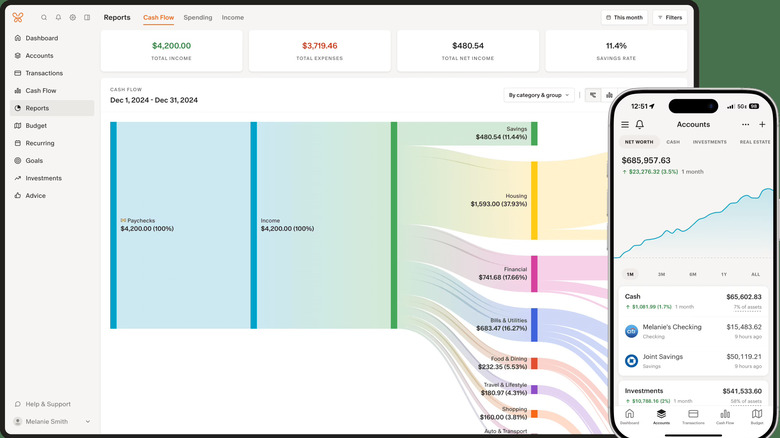

Monarch Money

Monarch Money is sort of the new kid on the block when it comes to replacing Mint. While it was founded back in 2018, it more recently raised $75 million to back its simple, design-forward approach to personal finance. The key with Monarch is its clean, user-friendly interface that puts a focus on the content and how it can help with your approach to budgeting. This budget app also features free collaboration with one partner — so it's a solid choice for spouses or significant others looking to help you fill out a complete financial picture.

Monarch Money does operate with a subscription model, it costs $14.99 per month, like many other similar apps, but it's transparent about why. Monarch promises that its leading data connectivity and decision not sell personal financial information are all tangible benefits of your monthly payment. Users also laud the multiple ways to slice and dice your budget, meaning you won't have to conform to one approach that may not fit your life.

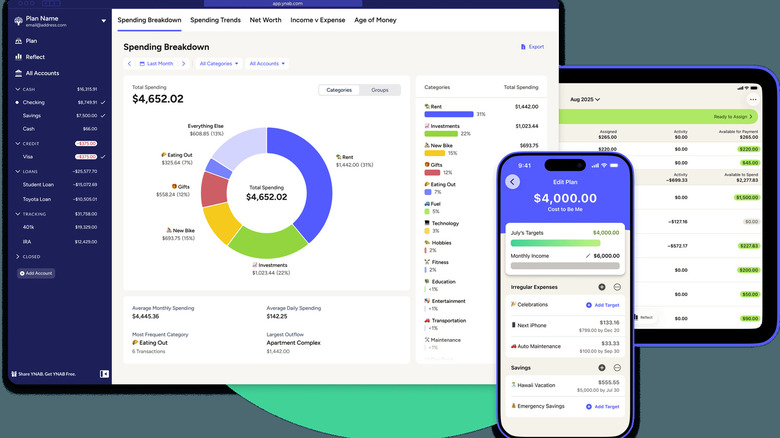

You Need a Budget

You Need a Budget (YNAB), one of the best finance apps to manage Apple Card spending, positions themselves as a method with an app in support of that method. What's the method? Making sure that every dollar you bring in has a job. The way this comes to life on the app is a system where you assign roles for each dollar. For example, $5 a week to coffee, $2 a week to your Netflix subscription, and $10 a week to savings. The idea is to bring intentionality to your money.

One of the strongest cases for YNAB is just how vocal its users are. Many Redditors are staunch supporters of YNAB's active (not passive) approach to finance. While some folks admit that it can feel manual and a little pricey at $14.99 per month, this investment in both time and money should boost accountability and make you more aware and passionate about reaching your financial goals. It's the completionist's way to replace Mint.

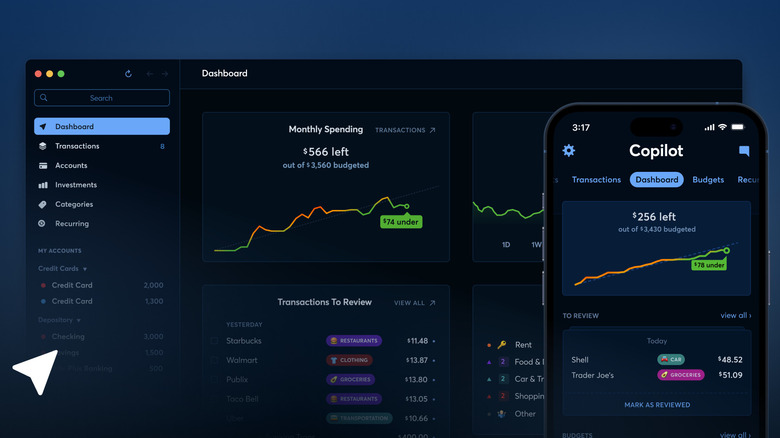

Copilot Money

One of the flashiest budgeting apps out there, Copilot Money, takes design cues from the Robinhood playbook — and that makes sense because it also features an investment tracking component that feels a bit beyond the more basic budgeting apps out there. What makes Copilot Money notable is its best-in-class app functionality. Featuring well-loved tablet, desktop, and mobile apps, it's an ideal option for those who want to build an "ecosystem" around their budget app. While other budgeting apps on this list offer cross-device support, Copilot Money has been improving its interface since 2020.

Some Reddit reviewers note that the price, $13 per month, can feel a bit steep, but what you're paying for is convenience and innovation. Copilot has a focus on cutting-edge tech, including rule-building and reporting. The team has recently launched AI features to help better categorize that spending. They've also earned numerous App Store editors' choice awards for ease of use and reliability.