5 Free Android Apps That Help You Save Money Every Day

Our bank balance always seems to drain faster than we think it should, and it's often because we are unable to effectively track our spending, get the most out of deals and discounts, or unknowingly shell out for subscriptions that we don't even use. Fortunately, there is a way to fix this and save at least some money from disappearing every month. As an Android user, you have access to millions of applications via the Google Play Store.

While not every option is a winner, there are some pretty good apps, including excellent apps for photography and avid readers. Similarly, the Play Store has a solid selection of money-saving apps that you can rely on to help you cut spending. Although many of these good personal finance apps are often paid or have very few features in their free tier, we have handpicked five that are either completely free or give you a solid selection of features in the free version.

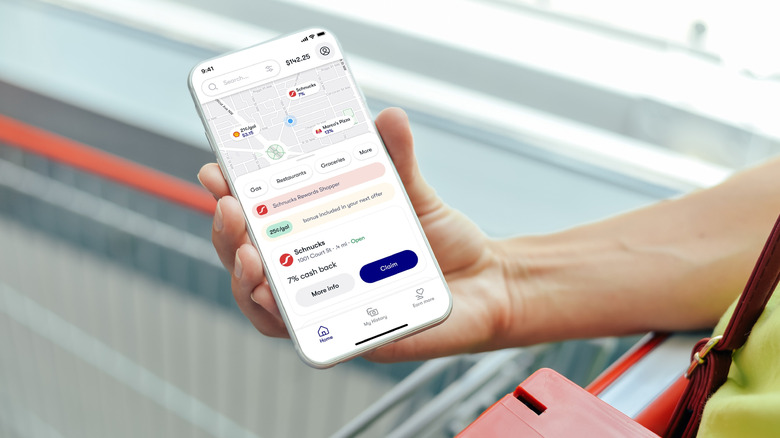

Upside

Upside is an excellent cashback app that can help you get some money back on your dining, gas, and grocery spending. It basically has partnerships with over 100,000 merchants, and when you spend at their stores, you get a bit of cashback. Some of its partners include 7-Eleven, Chevron, Giant Eagle, KFC, Shell, Save A Lot, Taco Bell, and Wendy's. The app claims its frequent users earn an average of $290 per year. It's pretty simple to use the app. Select an offer from a participating store before visiting it, pay with a linked credit or debit card, upload a copy of the receipt (in some cases, the app may auto-detect a spend), and you get the cashback in your Upside account.

You can cash out your savings to your bank account, PayPal, or as a gift card, and not worry about spending them through the app. However, keep in mind that you may have to pay a small fee for cashing out small amounts. Another good thing about using Upside is that you'll still get any loyalty or usage points that you would otherwise get on your credit or debit card for your shopping.

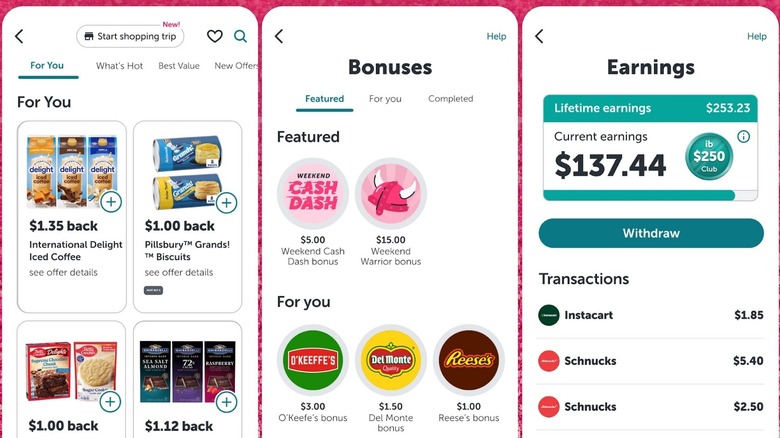

Ibotta

Ibotta is another solid cashback app that can be installed on your Android phone, and it complements Upside very well with its model of giving money back on specific products at participating retailers. More importantly, it has many merchants on its roster that you won't find on Upside, such as Walmart, CVS, The Home Depot, Olive Garden, Lowe's, Best Buy, and Bed Bath & Beyond. The app also works with online stores and services, such as DoorDash, Uber, eBay, and Hotels.com.

You find an offer you are interested in, apply it to your account, do the shopping, and then upload the receipt. You can also cash out your earnings to actual bank accounts, PayPal, or as gift cards. However, there is a $20 minimum payout requirement for bank transfers and PayPal. Other highlights of Ibotta include its bonuses during specific promotions that increase your savings, and generic offers that don't require you to buy a specific brand's products.

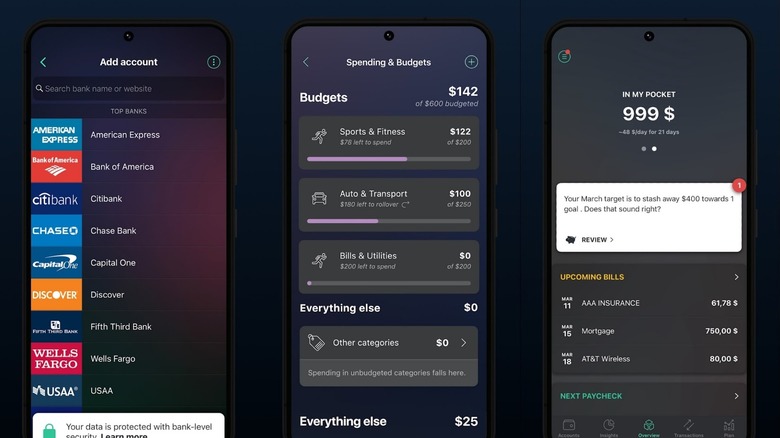

PocketGuard

PocketGuard is a budgeting and personal finance app that puts all your financial data in one dashboard. It can take details from your linked bank accounts, credit cards, and investments, and automatically categorize transactions and balances — helping you identify where your money is going. It can also spot recurring bills and subscriptions, schedule them, and let you know when they are due. Moreover, you can use it to pinpoint any subscriptions that you don't use and can cancel.

In other features, you can use the app to set goals for specific savings and limits for specific spending categories so that you don't end up overspending. Another big highlight of the app is its ability to let you know about your disposable income. It can take your earnings, budgeted expenses, bills, and any set goals into its calculations and then give you a number indicating what's safe to spend. Overall, it's a good choice for people looking for a relatively hands-off approach to budgeting and tracking their spending. While the free version of the app offers most of the essentials, you'll have to pay for features, such as cash transaction tracking, custom categories, and unlimited goals.

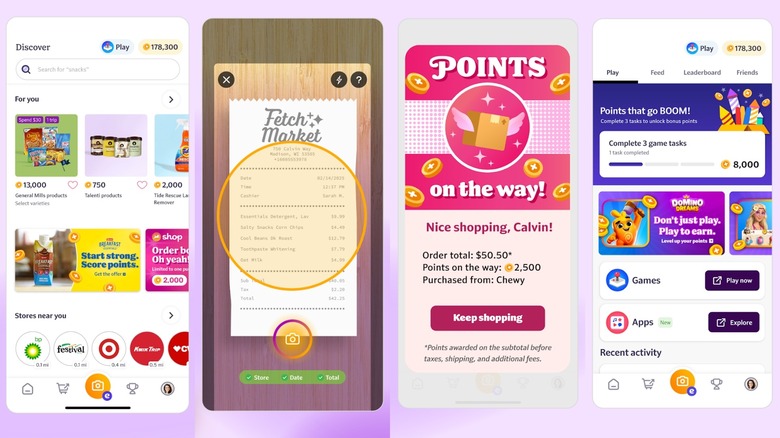

Fetch

Another excellent way to increase your savings every day is to use Fetch. It's a rewards app that gives you points for sharing your shopping receipts with it, and you can redeem these points to get gift cards from various retailers or Visa cards. It's minimal effort, and you can simply snap the photos of your receipts from any store, restaurant, or gas station, or connect your e-retailer accounts for automatic scanning of online order receipts.

1,000 Fetch points are typically equivalent to $1 in gift card value, and you can redeem as few as 3,000 points. Fetch also has partnerships with select brands, and if you buy products of these brands, you get bonus points. Moreover, you can play games in the app or refer other people to get extra points. Keep in mind, you can't cash out to a bank account or PayPal, but Visa cards are pretty versatile, and if you opt for a physical card, you can use it in stores or online.

Rocket Money

Rocket Money – previously known as Truebill — is a personal finance app that can help you save money by giving you a clear idea of where your money is going, including for any recurring subscriptions, which you can disable if you aren't actively using them. While it has both free and paid tiers, the free tier has a lot of useful features, including bringing all your accounts and cards in one place for easy access, daily transaction sync support, spending tracking, and alerts for upcoming payments. You can also set one budget to track it.

If you pay for Rocket Money's paid plan, you can also get automatic subscription cancellation, bill negotiation services, credit score tracking, and more. It shares a number of features with PocketGuard — another of our recommendations — but generally delivers better subscription management and bill alerts, whereas PocketGuard does a better job of daily budgeting and disposable income tracking.