Netflix Just Bought Warner Bros. And HBO: Here's Why It Matters

When Warner Bros. Discovery announced it would sell its film studio and streaming service to Netflix, it sparked concern and outrage amongst industry members, competitor studios, regulators, and theater operators. The $82.7 billion powder keg combines the first and fourth largest streaming platforms, Netflix and HBO Max, and brings popular franchises like "Harry Potter" and the DC Universe, classic films like "Casablanca" and "The Wizard of Oz," small screen sensations like "The Sopranos" and "Game of Thrones," and streaming hits like "Stranger Things" all under one roof, soliciting monopoly concerns in an industry already beleaguered by increasing rates of consolidated wealth, power, and access.

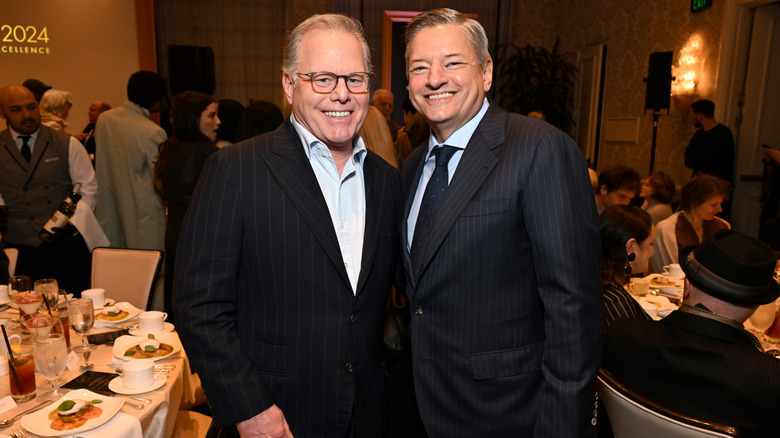

The fate of Warner Bros. Discovery has been at the forefront of industry discussions since June 2025, when the conglomerate's president David Zaslav announced that the entertainment giant would separate its film studios and streaming platform from its cable network business, which includes the likes of CNN, Cartoon Network, TNT, and HGTV. The choice of Netflix surprised many in the industry, as the streamer was seen as a longshot behind Paramount Skydance, headed by David Ellison — son of tech mogul Larry Ellison — and NBCUniversal. Tech giants Amazon and Apple also showed interest in buying the studio. Netflix itself had downplayed the possibility as recently as October 2025.

Despite the decision, the studio has a long way to go before joining the ranks of its streaming rival. For one thing, an arduous antitrust battle is sure to follow, as regulators, competitors, and industry stakeholders express concern over the newfound conglomerate's monopoly potential. An all-out push by Paramount Skydance to undercut the deal further muddies the waters, as Ellison instigated a $108 billion hostile takeover of the studio shortly after the Netflix announcement, kicking off what is sure to be an intense battle for the legacy studio.

Inside the deal

The public auction officially kicked off in October 2025, when Warner Bros. Discovery rejected three takeover bids by Paramount Skydance in favor of a broadened search that included Comcast, Netflix, and other industry giants. According to Reuters, October was a major milestone for Paramount, as it hoped to strike a deal before Warner Bros. Discovery separated its cable and film businesses, which would make it more difficult for Paramount Skydance's joint model to gain steam.

Prior to the announcement, Netflix was largely seen as a dark horse, with most observers believing Comcast and Paramount Skydance were in pole position. But for David Zaslav, Netflix's deal made the most financial sense, offering investors a valuation $12 billion higher than its market capitalization and a lucrative $5.8 billion insurance policy should the deal fall through – one of the largest in M&A history.

Another major driver was the immediacy of the deal's benefits. Comcast, reportedly the runner up to Netflix in the sweepstakes, had proposed a years-long overhaul of the company's structures, merging WBD's entertainment division with NBCUniversal to create a larger company, similar to Disney. Paramount, meanwhile, had raised its offer to $30 per share, for an equity value of $6 billion higher than Netflix, but Zaslav & Co. reportedly rejected the deal due to financing and debt concerns.

Monopoly concerns abound

Following the deal, regulators, industry members, and competitors sounded the alarm concerning Netflix's monopoly potential. Massachusetts Senator Elizabeth Warren, for exampled, called the deal "an anti-monopoly nightmare", noting it creates "one massive media giant with control of close to half of the streaming market. It could force you into higher prices, fewer choices over what and how you watch, and may put American workers at risk."

Hollywood mainstays like Jane Fonda and James Cameron echoed these sentiments, while the industry's largest unions, including the Writers Guild of America, Directors Guild, screen actors union SAG-AFTRA, and Hollywood Teamsters, expressed serious concerns, citing likely job cuts, heightened consumer costs, and wage reductions. By gaining control of HBO Max, Netflix will hold a controlling lead in a streaming war that has already drastically consolidated viewers, wealth, and decision-making power to select companies.

Prior to the merger, roughly 60% of streaming subscriptions belonged to three companies: Netflix, Amazon, and Disney. Netflix, by far the largest with 300 million subscribers across 190 countries, holds an approximate 80 and 104 million subscriber lead over Amazon Prime and Disney, respectively. Adding HBO Max's 128 million subscribers will give Netflix an anticompetitive advantage. Sporting a collective content budget of $21.7 billion, roughly $3 billion more than Disney, NBCUniversal, and Paramount combined in 2024, the conglomerate will wield substantially more bargaining power than its competitors.

Industry leaders have stressed that the scale of the merger trounces previous major M&As, namely Disney's acquisition of Fox in 2019. According to Marc-Olivier Sebbag, of France's National Exhibitors Association, the "landscape today is very different from what it was when Disney and Fox merged; Netflix has a big chunk of the streaming market and Warner Bros. Discovery is already a consolidated giant."

Death of the theater?

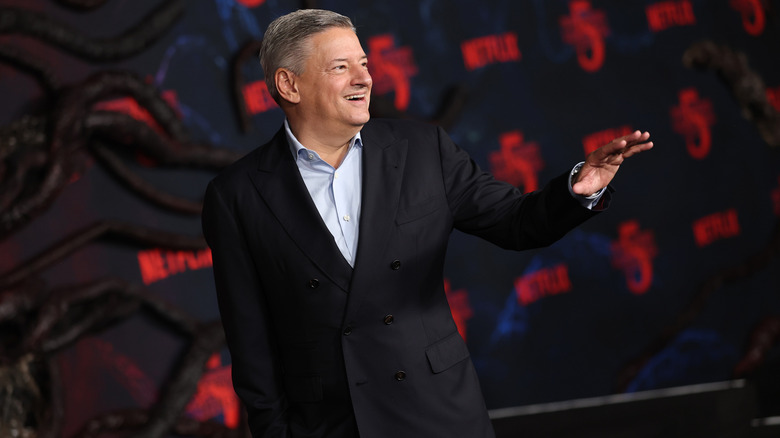

Following the announcement, a group of Hollywood's most influential producers released an open letter to Congress warning that the merger would "hold a noose around the theatrical marketplace." Theatrical groups have echoed these claims, as Cinema United, the country's largest exhibition association, stated the deal risks cutting domestic box office numbers by roughly 25%. Concerns are warranted, as Netflix head Ted Sarandos has called cinemas "an outdated concept," while working to move viewers away from cinemas by limiting theatrical windows and simultaneously streaming new releases. Of Netflix's 30 theatrical releases this year, only one – "KPop Demon Hunters Singalong" — was a wide release.

Ironically, the sale comes as WBD dominates the box office, releasing three of the top five highest grossing hits of 2025 — "A Minecraft Movie", "Superman", and "Sinners" — as well as critical darlingslike Paul Thomas Anderson's Oscar favorite, "One Battle After Another". Prior to the sale, the studio announced it would continue target 12 to 14 theatrical releases a year , which will include a roster of highly-anticipated films like "Dune: Part Three," "The Batman," and "Superman" sequels, as well as Alejandro Iñárritu's upcoming Tom Cruise flick and Margot Robbie's "Wuthering Heights" remake.

For his part, Sarandos stated in a December 5, 2025 investor call that Netflix will bring Warner Bros.' movies to theaters, honoring existing contracts through 2029. Netflix insiders have also stressed that the company doesn't plan to change WBD's business practices in the near future. But observers have noted that these commitments are a legal necessity, rather than an endorsement of the theatrical business model. Sarandos further undercut trust in Netflix's commitment to theaters in the same conference call, when he criticized theatrical windows as not being consumer friendly, instead reiterating that Netflix's "primary goal is to bring first-run movies to our members."

Paramount pushes back

One obstacle standing between Netflix and its Warner Bros. coup is an onslaught of legal, financial, and political pressure that Paramount Skydance and its CEO, David Ellison, will leverage to block the deal. Just days after Netflix's announcement, Paramount launched a $108.4 billion hostile bid for the studio, promising Warner Bros. Discovery investors roughly $18 billion more cash-in-hand. Paramount's sixth offer in twelve weeks, the Ellison family's bid brings together a who's-who of questionable financing, including Saudi, Qatari, and Abu Dhabi's sovereign wealth funds, and Affinity Partners, a private equity firm headed by President Donald Trump's son-in-law Jared Kushner.

For Warner Bros. Discovery investors, the proximity to the President and his financial interests could promise a swifter anti-trust process. The Ellisons, for their part, have already publicly lobbied the administration to stop the merger. Trump has echoed these sentiments, stating that the Netflix deal "could be a problem" at an event shortly after the announcement. But for a movie industry that prides itself on a century's worth of championing free speech and anti-authoritarianism, tying one of the largest studios to both the President and foreign governments with longstanding histories of human rights abuses is understandably worrisome.

These concerns are underscored by Paramount Skydance's insistence on including Discovery's cable package, which notably includes CNN, in the deal. Adding a package of CNN and HBO to a family portfolio that includes CBS News and the American version of TikTok comes with its own antitrust concerns. The likely rightward push of these media entities seems both a result of, and potential guarantor, of their acquisition, as the Ellison family has already discussed potential changes at CNN should the White House support Paramount Skydance's acquisition of the network.

What happens next

Even if Warner Bros. Discovery rejects Paramount's latest overture, Netflix's acquisition will undergo an intense regulatory battle on both a domestic and foreign stage, as the studios' international footprints will certainly expose the merger to foreign regulators, particularly in Europe. Consumer class action lawsuits will also challenge Netflix's timeline. A key aspect of this upcoming antitrust battle will debate what market Netflix operates in, a question that is more complicated than it seems. For instance, if judges broaden the scope of Netflix's competitors to include visual media giants like YouTube and Meta, Netflix's argument becomes much easier.

No matter who wins the battle for Warner Bros., layoffs will almost certainly be in the cards. Reportedly, both Netflix and Paramount have touted their acquisitions as cost saving measures for Warner Bros. Analysts predict that a Paramount takeover would lead to at least 6,000 job cuts as Paramount pursues roughly $6 billion in savings over the first three years. And while Netflix's lack of a comparatively scaled production studio has some hopeful that layoffs will be less drastic, Netflix's projection of $2-3 billion in savings suggests otherwise. Despite claims to the contrary, the sale will likely decrease total film output as well, as previous sales of legacy studios has resulted in major decreases in production. For instance, Disney's acquisition of 20th Century Fox caused a 46% decline in collective output.

Ultimately, there may be no happy ending to the Warner Bros. saga. No matter the winner in this bidding war, fans and industry members alike will likely face a weakened film industry with less affordable viewing options, fewer movies, and a lack of theaters to watch them in. At the end of the day, most consumers might end up wishing no sale occurred at all.